If you grew up in the India of the 1950s to 1990s, you’d be privy to cartoonist R. K. Laxman’s famous “The Common Man” series.

Started in 1951, the Common Man was a daily comic strip that represented the hopes, aspirations, troubles and foibles of the average Indian. That is, the average Indian MAN.

What about the average Indian Woman? The girl who works many tasks from morning to evening, juggling paid and unpaid jobs aplenty.

When asked about it, R K Laxman apparently said, “you see… women can never be common”.

I do have a number of things to say in response to RKL, but time is short and energy is limited, so, as always, we move on.

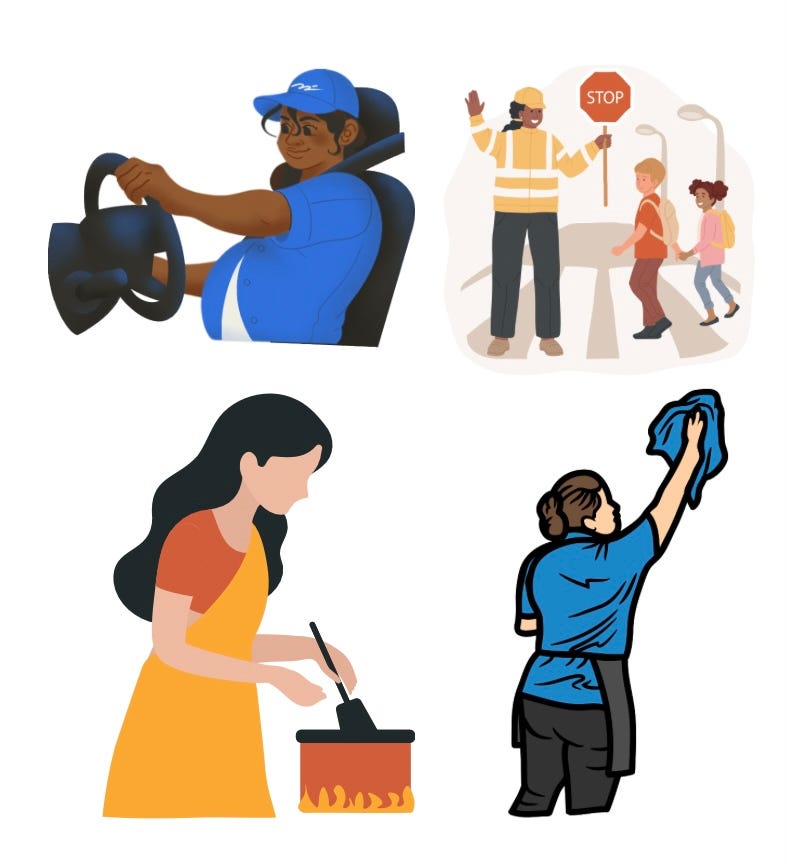

Who is The Common Woman in today’s India? The security guard you see at the gate, the conductor in the school bus, the building manager in your complex, the supervisor inside your office premises, the helper dusting and cleaning the house, the cook sorting breakfast-lunch-dinner, the occasional cab driver, the hair dresser… all those millions of Common Women who have their aspirations charted out aplenty.

This morning, as I wait for the school bus at the front gate, J’s husband drops her off on his scooter, as always. She’s ready for the job at hand, as she navigates three houses deftly, chopping onions and garlic, boiling lentils and rice, rolling out the dough for rotis, and finishing off odd jobs in the kitchen within an hour each. She earns around INR 25K a month, a sum that makes her an equal breadwinner at home. But, but…

Does she have access to that cash?

While India has a billion bank accounts and a strong push for digitising money, many of the common women of this country do not have the luxury of access to these digital accounts. Managed by the men in their lives, the accounts and the money that comes into them aren’t their own, except in name.

In fact, J prefers to collect her wages as cash so she can stash a fraction away as savings in her little kitchen container before handing over the rest towards the household, as the “salary”.

This amount J squirrels away never grows, not even at savings bank account rates, staying as cash, losing value over time. Unless… J decides to join some chit fund scheme where a group of women get together to give loans to one of their own at high interest rates. But, this usually turns out to be a vicious cycle because the women who take those loans are usually funding a non-revenue generating use case, returning a loan incurred by their husbands or managing a medical expense they aren’t insured for.

Over time, J either swings riskily towards putting all her eggs in the chit fund basket or takes many steps back and keeps her cash simply as cash, till depreciation and / or demonetisation do her in.

Ah. That’s a sob story not befitting this festive season, is it?

But there’s a reason we need to be conscious of these stories, of the common women we believe are empowered and independent, because they earn their own money.

In Independent India, women’s financial independence is still a long and hard road to traverse, at every Socio Economic Level. And it’s one that needs much fixing - structurally, societally and within families.

As we ‘Build for Bharat’, we need to remember to build for the women of Bharat as much as for the men of Bharat. For, it is easy to get lost in the “average” definition which is the definition of the average man, the Common Man.

This is Part One in a series about the Common Woman, because she is a Girl At Work who deserves her own series.

Anddd subscribe!

So many thoughts racing through as I read this awesome piece - Building for Women of Bharat, how demonetisation took away all the cash women secretly stowed away for a rainy day (a tragic collateral damage), women can earn more but neither they nor the men will ever see it that way…